🍪 TWiC: HBM4, SiPho's Rise, Memory eats All, 2nm Mo-Contacts,++

This Week in Chips: Key developments across the semiconductor and adjacent universes.

I am working on a deep-dive about the role of CPUs in agentic AI, and a framework for deciding what CPU is good for what kind of workload. It should be out early next week.

Two Semi Doped podcast episodes out last week:

The future of financing AI infrastructure with Wayne Nelms, CTO of Ornn

Meanwhile, here’s what went down This Week in Chips.

The Race to HBM4 and NVIDIA Allocations

A SemiAnalysis note sent out a few weeks ago to their Core Research subscribers stating that Micron will have zero share of HBM4 on NVIDIA Rubin apparently hit the airwaves pretty hard. CFO Mark Murphy of Micron held an analyst meeting to dispel investor fears stating that Micron is already in high-volume HBM4 production with customer shipments underway - a full quarter ahead of the timeline they gave in December with speeds exceeding 11 Gbps. Murphy took a direct shot at the note:

Quote from the call - emphasis mine (transcript):

And let me, at this time, address some recent inaccurate reporting by some on our HBM4 position. We have been in high-volume production on HBM4. We've commenced customer shipments of HBM4, and we see shipment volumes ramping successfully this calendar Q1. This is a quarter earlier than we mentioned during our December earnings call. Our HBM capacity is ramping well, and we have sold out our calendar year '26 HBM supply as we highlighted a few months ago. Our HBM yield is on track. Our HBM4 yield is on track. Our HBM4 product delivers over 11 gigabits per second speeds, and we're highly confident in our HBM4 product performance and quality and reliability.

The call does not explicitly mention that they do have NVIDIA share, or allude to it in any way. Other industry publications like FundaAI pointed out that they do not believe that Micron has zero HBM4 share on Rubin, emphasizing that NVIDIA isn’t the only buyer anyway, and that any incremental HBM supply will be absorbed by competitors.

Meanwhile, SK Hynix is expected to begin mass shipments for Nvidia’s Vera Rubin platform as early as mid-February. Their HBM4 was developed on 1b DRAM despite skeptics questioning whether it could match 1c-based rivals.

Samsung also announced that it had delivered the industry’s first commercial HBM4 shipments. The 12-layer HBM4 runs at 11.7 Gbps standard (up to 13 Gbps), offers 24-36 GB capacities, and delivers 3.3 TB/s bandwidth - a 2.7x improvement over HBM3E with 40% better power efficiency.

Trendforce’s HBM allocation estimates for Nvidia are: SK Hynix in the mid-50s percent, Samsung mid-20s, Micron around 20%. If you believe that Micron’s share is actually 0%, then allocation estimates would be: SK Hynix 70%, Samsung 30%.

Silicon Photonics’ Breakout Moment is Here

Silicon photonics had a breakout week with two different major data points all pointing in the same direction: this market is bigger and more urgent than anyone thought six months ago.

GlobalFoundries

GlobalFoundries’ (GFS 0.00%↑) recent earnings call stated that they secured a CPO design win for scale up networks, which some are guessing is related to Cisco/Acacia. Their SiPho revenue in 2025 was ~$220M with an expected doubling in 2026, and aiming for a $1 billion annual revenue run rate by end of 2028.

GFS has been on quite an acquisition spree. They acquired Advanced Micro Foundry (AMF) - a SiPho foundry in Singapore to try and become a pure-play SiPho foundry. They acquired InfiniLink - a design company with optical connectivity expertise including SerDes, transceiver chipsets and monolithic SiPho products. Their capex spending estimates in 2026 are ~$1B-1.4B (15-20% of revenue) with investments primarily towards SiPho, SiGe for things like transimpedance amplifiers and other transceiver components.

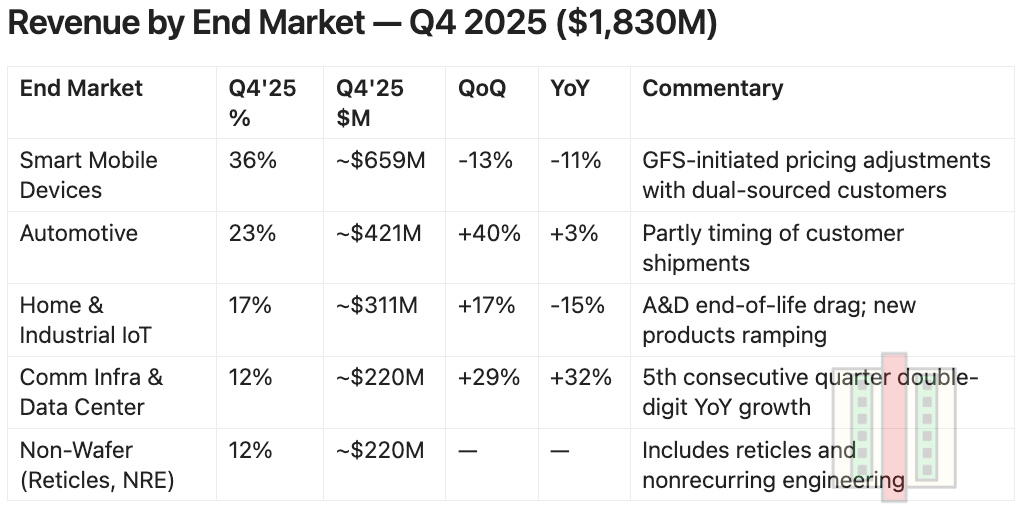

The table below shows GFS revenues by end market. Comms infra and data center revenues are by far the most promising, with smart mobile devices showing significant decline from all the memory pressures facing the smartphone industry.

“2025 was the first full year where more than 60% of GLOBALFOUNDRIES’ total revenue came from markets other than smart mobile devices.” — CFO Sam Franklin

Tower Semiconductor

Tower Semiconductor (TSEM 0.00%↑) is going even bigger. After Intel walked away from their Fab 11X agreement, Tower announced a revamped strategy centered on a $650M + $270M recently announced (total $920M) SiPho/SiGe capacity buildout targeting 5x their current Q4 wafer shipments, in 2026.

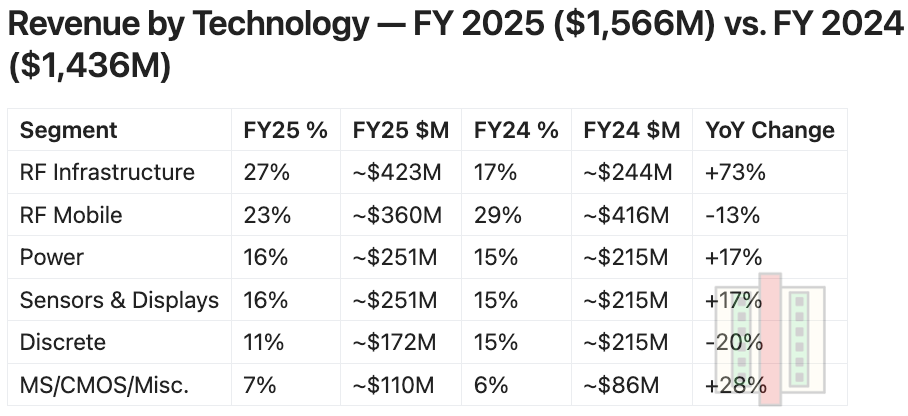

SiPho alone made $228M in 2025 vs. $106M in 2024 (115% YoY growth), with $95M coming from just Q4 ($380M annualized). With SiPho + SiGe, revenue is $421M in 2025 (27% of corporate), up from $241M (17%) in 2024. >70% of total SiPho capacity through 2028 is already reserved or in the process of being so - with customer prepayments in place.

The table below shows revenue broken down by end markets. It is clear that their SiPho business is booming with a 73% YoY change. RF mobile segment is down again, and is a common pattern among the two biggest fabs supporting RFSOI technology for RFFE.

“The insatiable demand for compute bandwidth in both scale-up and scale-out architectures and Tower’s exceptional ability to scale the capacity flawlessly in partnership with our customer has made 1.6 Tbps, the fastest-growing silicon photonics node in the industry to date, with Tower being by far the majority supplier of 1.6T silicon PICs.” — CEO Russell Ellwanger

Memory Shortage Eats All, But There is Hope

The HBM buildout is sucking wafer capacity away from conventional memory, and the downstream effects are getting ugly. Take Cisco for example. Cisco reported a beat on revenue but guided gross margins to 65.5-66.5% for the April quarter, well below Street’s 68.2% - memory costs were the culprit and the stock dropped >10%.

The demand for HBM is not going away with $650B of AI infra capex being allocated for 2026. But that does not mean that DRAM supply will be constrained forever. There are definite economic and supply chain reasons why we will see more DRAM supply coming in the latter half of 2026. Continued after paywall.