🍪 TWiC: Google/AWS CapEx, NVIDIA GPUs, SaaS, TXN+SLAB

This Week in Chips: 5 key developments across the semiconductor and adjacent universes.

Here’s what went down This Week in Chips.

Google Spends Capex like a Drunken Sailor on Shore Leave

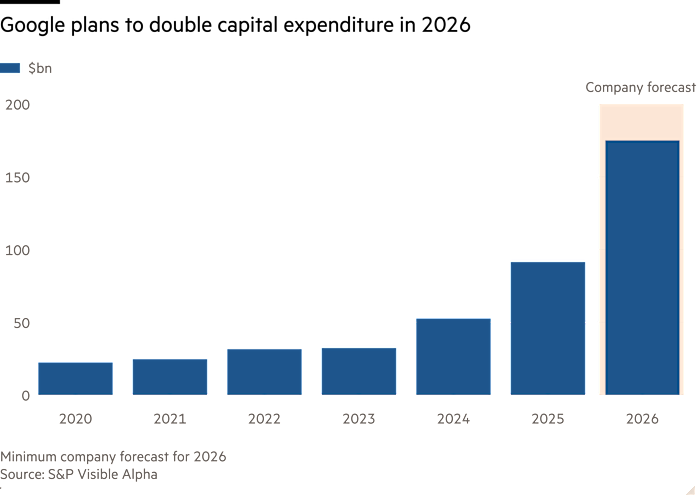

In their latest earnings call, Google’s capex is set to more than double from $91.45B in 2025 to $175-185B in 2026 (expected number was $120B), driven largely by accelerated investment in AI servers and large-scale TPU deployment. There seems to be no slowdown in AI spending here.

With this much coin in the game, Google’s TPUs are set to be a real threat to NVIDIA’s dominance in the space. Broadcom is going to be making a lot of chips here, but also MediaTek who have secured orders to the v7e low power TPU variant. Google’s rising tide will lift all boats. HBM demand will stay massive, with reports that Samsung will be primary Google memory supplier in 2026. And TPU pods need tons of optical circuit switches putting Lumentum’s MEMS OCS in the spotlight.

Via Financial Times.

Sick tweet. Google > Russian defense budget.

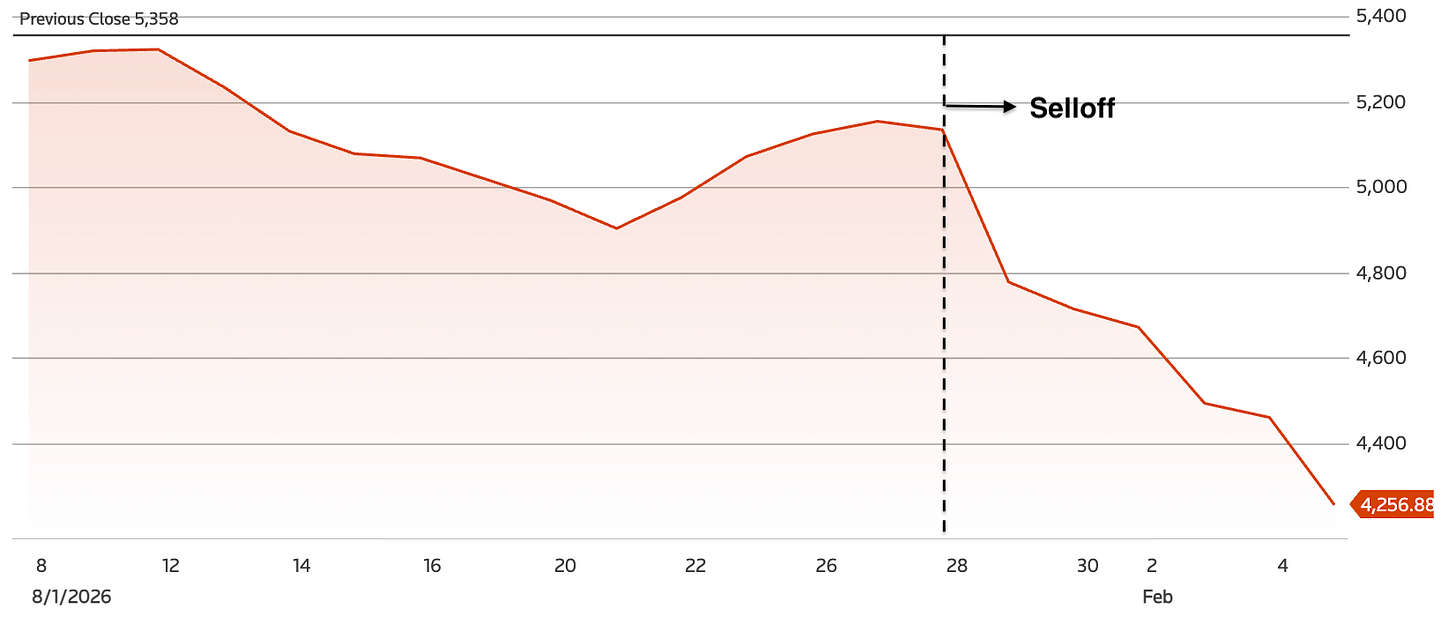

Amazon Outdrinks Google/Meta, Spends Even More Capex

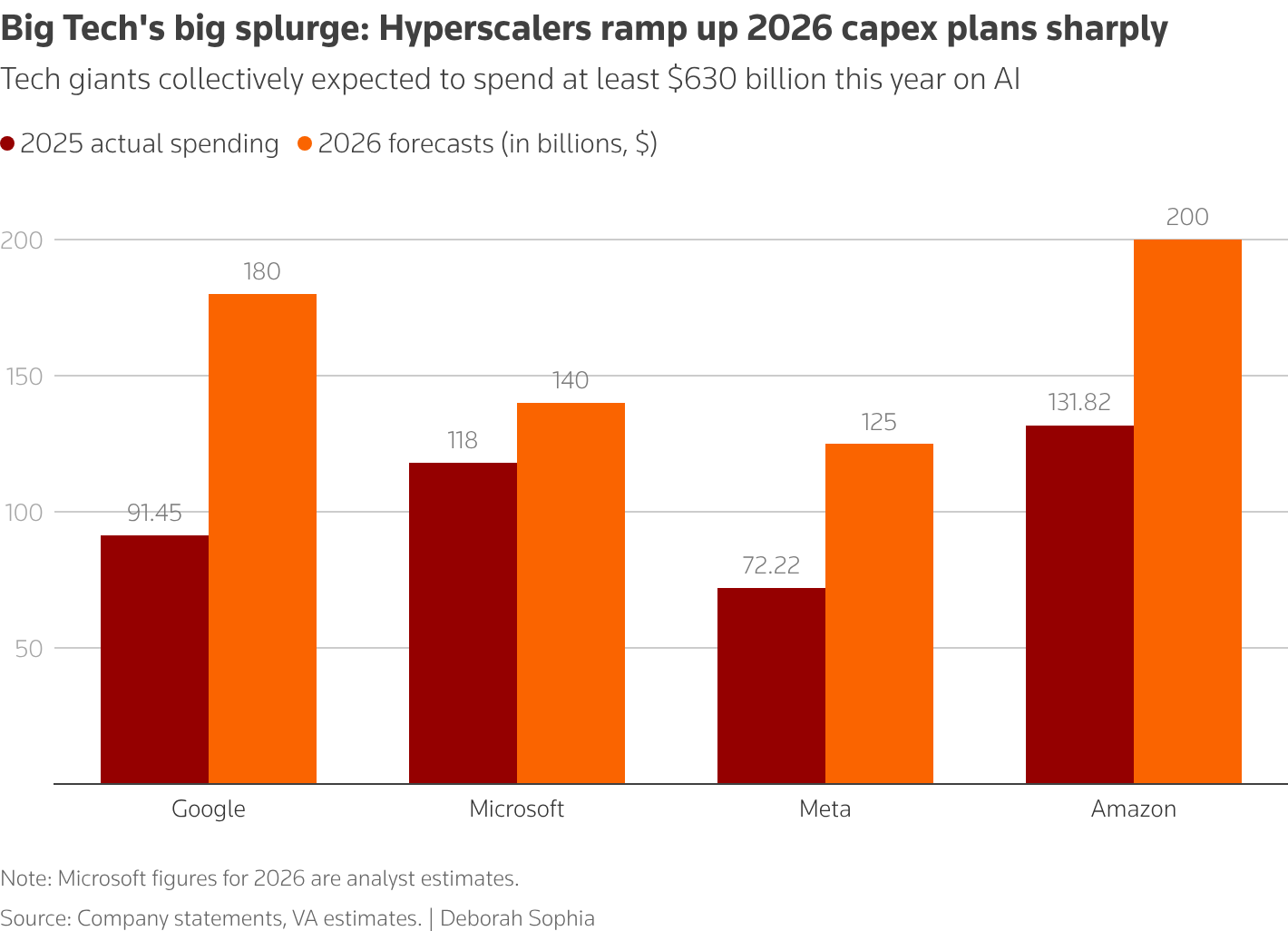

If you thought Meta’s $125B planned capex for 2026 was bad, and Google’s $180B was insane, how about Amazon’s $200B capex spend plans for 2026? The capex consensus was $146B and the planned outsized spending worried investors and stocks fell 10-15% post announcement.

The main concern was whether there is actually customer demand and a meaningful path to revenue here, or they’re just keeping up with the Joneses. Compared to Google’s cloud revenue that grew 48%, Amazon’s cloud revenue grew 24% and the market does not like that they’re spending more than Google with lower cloud revenue. They’re plowing back more revenue into investments and taking a more aggressive stance on capex spend. Some analysts like UBS are optimistic and raised capex estimates for AWS to $260B in 2027.

via Reuters.

Here is an optimistic tweet.

NVIDIA Throws Out GPU Baby With AI Bathwater

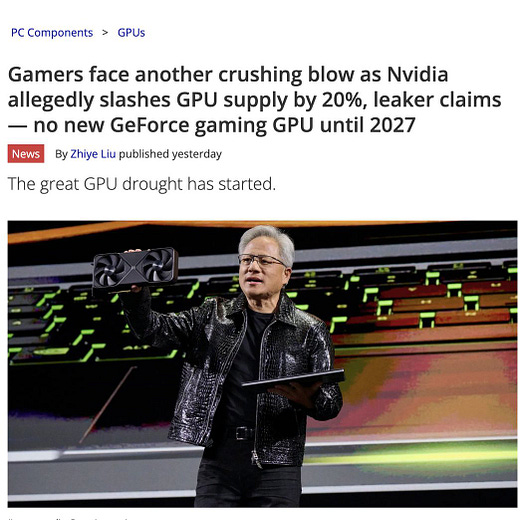

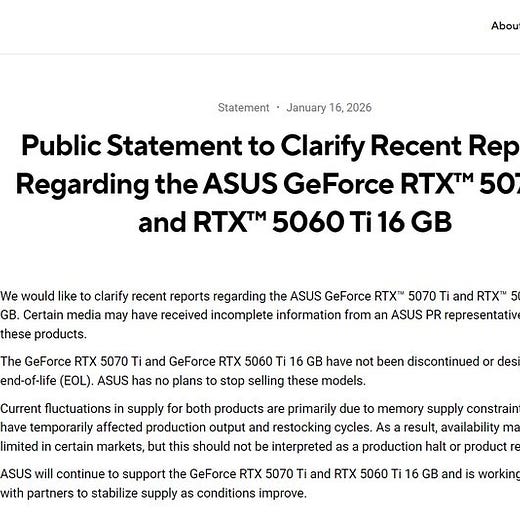

With a global memory shortage driven by their own needs for HBM for AI datacenters, NVIDIA is now short of memory for gaming GPUs. NVIDIA has always announced some new gaming GPU product, whether it is a new architecture, refresh or variant, nearly every year for at least two decades now. Unless it is misinformation, The Information reports that NVIDIA does not plan to release any gaming GPUs in 2026. The RTX 50 series was introduced in 2025, but word has it that the RTX 60 series announcements will be delayed to 2027.

via Tom’s Hardware.

Tweet that goes beyond the call of duty.

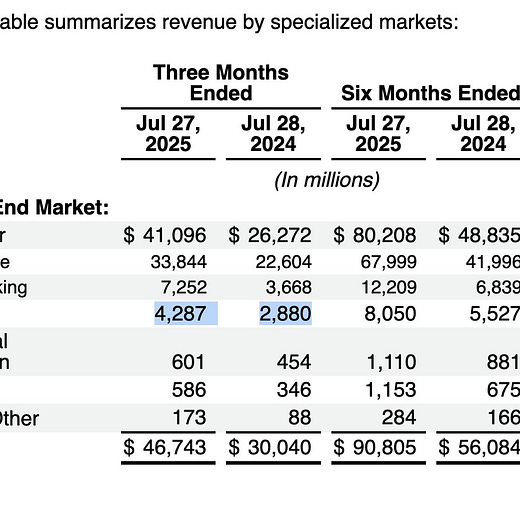

Trouble in SaaS: Software-as-a-Selloff

Headline is not mine but I saw it on the TMTB Substack chat and liked it so much that I had to steal it 🤣. While this is not a direct semiconductor story, the rapid advances in AI have put investors in a panic mode over how software has been taken over by coding agents since late January. This has wiped out approximately $1 trillion in market value from the software and services sector.

Doug O'Laughlin from Fabricated Knowledge has write several insightful posts on the death of software, the first of which was published mid-last year, and the second part in mid-Jan 2026 - just before the panic selling started.

Of course, there are two sides to every story. Many view AI coding agents as an enabler where increased productivity at cheaper costs means that more people will use it (Jevon’s paradox) driving software to newer heights that we are yet to witness. Time will tell.

Everything’s Bigger in Texas (Instruments)

Texas Instruments has signed an agreement to acquire Silicon Labs, a wireless SoC company based in Austin, TX, for $7.5B. Silicon Labs stockholders will receive $231.00 in cash for each share of Silicon Labs common stock they hold at the time of closing which is expected in the first half of 2027. SLAB 0.00%↑ is up 50% since the announcement.

About 20 years ago, TI actually had a wireless business (where I was an intern for two summers) where they were pursuing an all-digital approach to radio. They figured if ADCs were good enough, then why not just do everything in the digital domain. But the idea didn’t really catch on, and the Wireless Technology Business Unit was shut down sometime in 2009.

TI’s dominance has always been in analog and power chips but the proposed acquisition of Silicon Labs brings in much needed wireless capabilities to the company with its portfolio of 1,200+ products covering Bluetooth, Zigbee, Matter and Wi-Fi SoCs. The benefit to Silicon Labs is that they get to leverage TI’s in-house 28nm foundry facility that is perfectly suited to RF SoC products. Silicon Labs’ chips are “everyday semiconductors” that do not need cutting edge nodes, and having a US-based, in-house fabrication facility will bring down the cost of manufactured products. The synergy is expected to produce ~$450M annually by 2030.

via TI Investor Page.

Have a great weekend!

Is anybody making money off AI? Has AI been integrated into companies? Would AI be missed in our day to day life if not available?

What is really the hype with AI and does it deserve these crazy valuations and investments?

Haha I loved this!